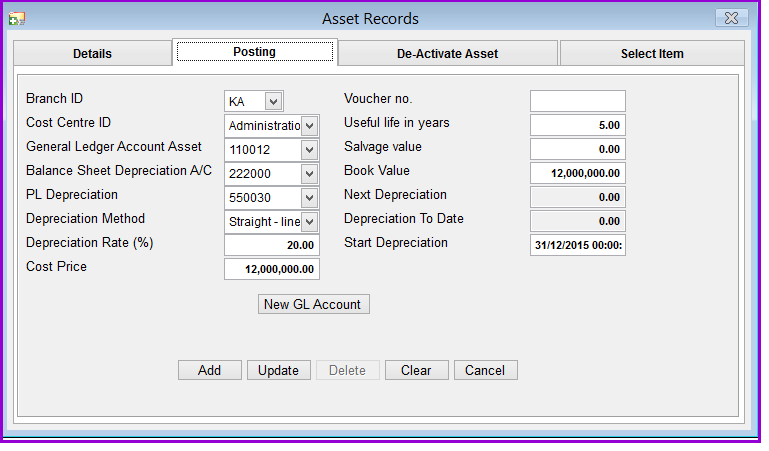

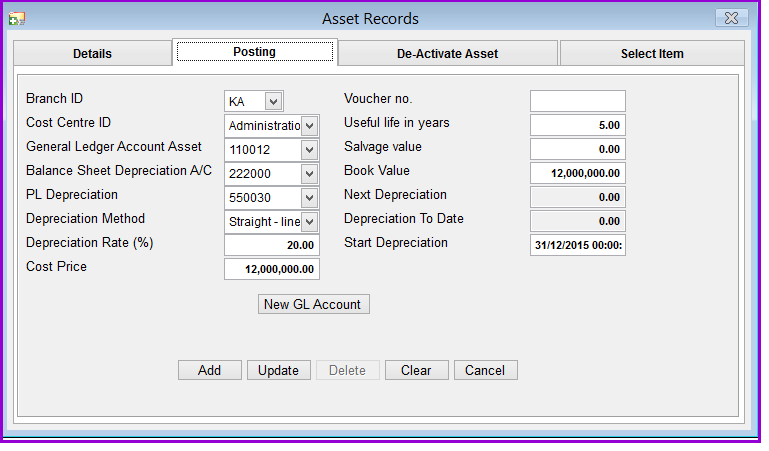

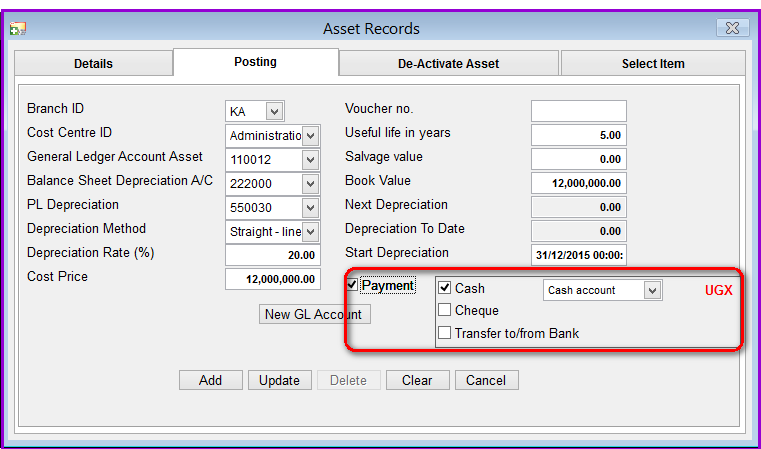

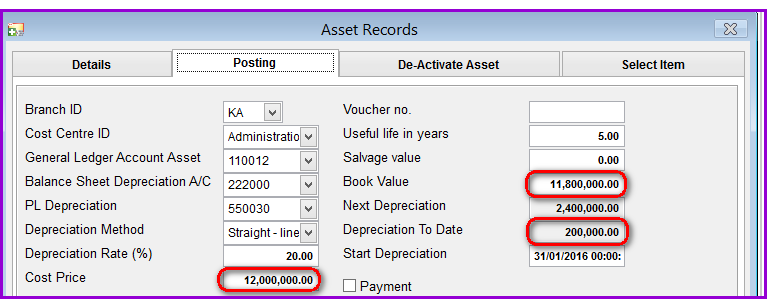

This page of Loan Performer allows a user to post the asset accounting entries to the selected GL accounts after transactions like buying and selling of assets and depreciation at the end of the period. This keeps the record of assets up to date and posts the costs to the profit and loss account thus reducing the value of the assets on the balance sheet. The Posting tab enables you to make settings that will affect the calculation and recording of depreciation at the period end.

How to post the accounting entries

To make settings for assets postings you go to Accounts/Assets/Asset Register/Postings and a screen will be displayed as follows:

The Nº 1 Software for Microfinance